The new year started off in weird fashion when a group of day traders put GameStop and AMC Theaters back in the news when their stocks skyrocketed in late January. If you’ve ever seen Martin Scorsese’s 2013 film, The Wolf of Wall Street, this idea of “shorting” is nothing new. As I understand it, “shorting”, or “short-selling”, is borrowing stocks and selling them off at market value while predicting their value will diminish. People will borrow the stocks for a set amount of time, and then they have to eventually buy the stocks back while hoping that their prediction is correct.

If it goes well, the trader returns the stock and takes the difference. It’s a risky strategy as you could be “short- squeezed”, which is when the stock may not lower as much as you expect and thus you have a decision to make. This became a headache for big-time professional investors, called retail traders, who usually make a living off of “shorting”.

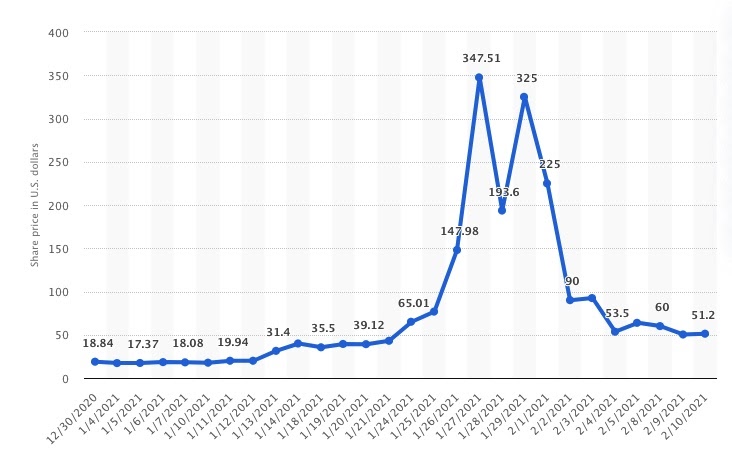

The team of Reddit users created a David vs. Goliath dynamic between the two investing groups. The small-time day traders began driving up the prices of the stocks which left the established retail traders with a proverbial grenade in their hands as they would lose money. This graph below* is taken from statistica.com and shows the meteoric rise in late January. GameStop’s stock went up at least 1,700% during this time, and the retail traders likely let out a sigh of relief when different trading outlets like Robinhood stopped the bleeding for a little bit by blocking the trades with GameStop among other companies. Interestingly enough, GameStop’s stock was actually trending upwards before all of this happened. They brought in new executives who placed a heavy emphasis on digital sales, which seemed to grab

the attention of investors. The whole Reddit situation only gave it even more of a boost.

AMC Theaters was also propped up by day trades in the days following the GameStop news. Even as an avid movie goer, I still am a bit dumbfounded by the decision to go after these failing businesses such as brick-and-mortar video game stores in an era where digital purchases are more prominent and movie theaters which are stripped of any sort of tentpole or new releases. I am by no means an economics expert, but this whole play doesn’t seem sustainable. It’s great that some people jumped on a fad and made money but this whole system is incredibly risky.

Another thing to consider is the logistics of the legality of it. As of right now, the Reddit traders haven’t spread any fake information that would sway the trends of stocks, but it remains messy at best since there was collusion within the Reddit thread.

This wild David vs. Goliath story has seeped its way into pop culture. Twitter was flooded with memes within days of this all happening. Like a lot of culturally-significant events, the whole situation with Reddit, trading, and GameStop is going to be adapted into a film. There were already numerous other projects that were in-development about the rise and fall of GameStop, but the recent events have given people even more material to write and create on the subject.

While this story seems to have died down a bit since it started, the Reddit traders are still trying to make money as they shifted focus towards marijuana distribution stocks. That didn’t seem to go as well as GameStop, as the weed stocks plummeted this past week. We’ll see if and how the Reddit traders continue on from here.

Either way, this David and Goliath story has turned the stock trading world on its head, and provided a new way for private investors to aggregate interest in the way large trading corporations already do.

Sources: CNN, CNBC, Statista, The Verge

*Image Description: This graph follows the growth in GameStop stock prices from December 2020 to February 2021.